An Introduction to FinClub.AI

“These are uncertain times.”

This phrase always makes me smirk. I mean, sure, it’s a credible

statement, but when was the last time things were certain?

Everywhere you look, there’s a duopoly of the best of times and

the worst of times. This couldn’t be truer than in today’s markets.

We are 9+ years into the longest (arguably pseudo) bull market

ever, and with recent corrections, soapbox traders are falling over

themselves to either make the next bubble prediction or to

contend with those that do.

The

purpose of these articles is to try to help those who are relatively

new to the trading community make sense of the diverse - and at

times, predatory - investing ecosystem. They are also intended to

shed light on general “best practices” we have observed during

the development of FinClub.AI. This will not be a resource for the

“pros” out there. Frankly, if you’re taking someone’s money in

exchange for investing advice, you should already be well aware

of the types of subjects I’m going to cover here.

As the title suggests, this particular article will focus on my own

company. FinClub.AI is the culmination of several years’ worth of

hundred-hour weeks from a small but highly skilled team of

trading professionals, machine learning experts, and quantitative

analysts (math nerds) like myself, not to mention enough pots of

coffee to float an aircraft carrier. We utilize massive amounts of

market data and artificial intelligence models to deliver the best

possible setups on the U.S. equities markets. Our “picks” are

rooted in risk mitigation, allowing only those with the highest

probability of success and sufficient liquidity to prevent

manipulation (a subject worthy of its own article) to pass. The

information provided to our subscribers allows them to make

better informed decisions, whether they trade a derivative security

or the underlying equity, in a shorter amount of time… pretty

simple really, at least from the outside looking in.

What primarily differentiates us from our most similar competitors

is the win rate our risk managed approach returns. Others will

gloat and hide behind marketing materials what should be a

concerning sub-50% result. Our model combs through tens of

millions of data points on a daily basis, subjecting each symbol to

countless rigorous criteria on its path to consistently delivering

winning positions at a rate above 75%. We breathe easy with the

thought of minimal drawdowns working in concert with the miracle

of compounded returns. Looking back, it’s hard to tell the

difference between the hard work and serendipity that brought us

here. In any case, the takeaway is that the A.I. we’ve built is very,

very good at what it does.

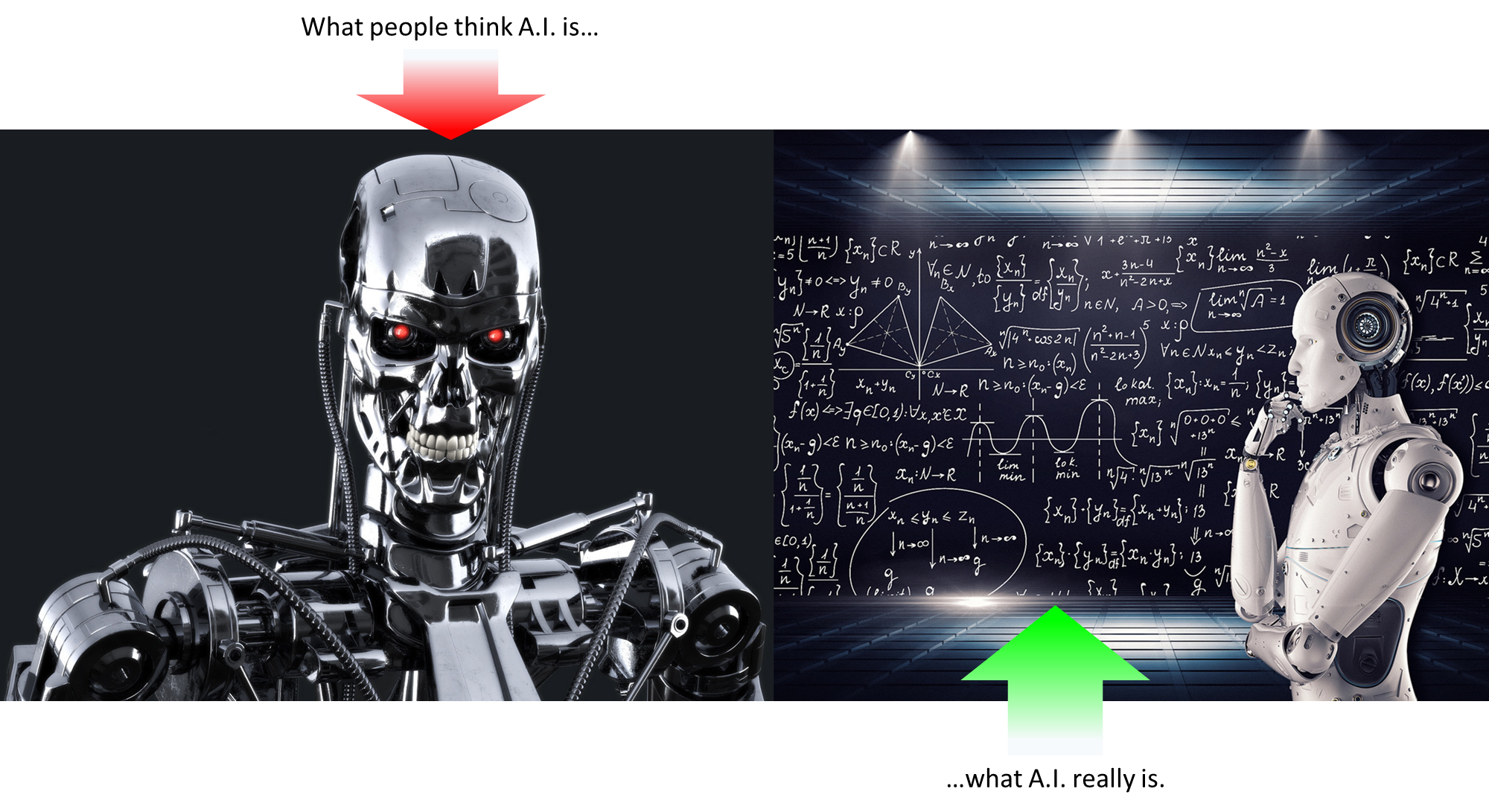

Artificial Intelligence trading solutions, much less quantitative

algorithms (math programs), aren’t new. Pioneers in the field such

as James Simons and Thomas Peterffy have yielded impressive

results for decades outperforming the standard benchmarks;

however, most of these companies have hidden their tech from

the light of day, only to be used by internal hedge funds and prop

shops. It’s their right to do so, but I can’t say it isn’t disappointing.

It’s disappointing for the same reason I give when asked why we

don’t do the same.

Actually, let me back up… Do we use our own product? Yes, of

course we do. We use it because we like making money and

we’re not idiots, but that wasn’t the question. The question was,

“why would we let anyone else benefit from our software instead

of JUST using it ourselves?” I hope you’re comfortable:

- This is not a zero-sum game.

Say you’re playing basketball with one of your friends, and

you’ve only got 18 points when he sinks a jumper to win with

21. In basketball, your friend takes home the win while you

chalk up the L. That’s zero-sum. Now imagine those points

were trading profits. Sure, you didn’t score the most points,

but you’re going to start tomorrow with 18 more points than

you had today. Similarly, your selling of an asset today for a

profit doesn’t preclude someone else from selling the same

asset for a profit tomorrow.

In other words, allowing others to use our product to win at

trading doesn’t lessen our ability to also win with the same

program.

- Rising tides raise all ships.

On a macro level, investor confidence – the same

confidence which leads individuals to put money into the

market – leads to growth and overall healthy market

behavior. Unfortunately, there are still many sitting on the

sidelines, reeling from the aftereffects of the GFC. What’s

worse, there is no shortage of schemes designed to take

advantage of those just entering. We believe this is

effectively financial cannibalism, and providing the individual

retail investor with reliable tools is our best way of improving

conditions overall.

- It is morally wrong to arm the individual with a knife for a

gunfight with institutional investors.

I can’t think of a more direct way to say it. The big

institutional investors (investment banks, large hedge funds,

and so forth) have tools, resources, and capital at their

disposal that you do not to put themselves at a near constant

advantage. It is our hope that by providing FinClub.AI to

retail investors, we can help tip the scale, and in doing so

circumvent many of the rapacious practices we’re all familiar

with.

It is our founding principle to act in the best interests of the

individual. Period.

I hope you’ve enjoyed reading this. It’s been my pleasure to shed

a light on who we are and what we stand for.